What Is a Fixed Index Annuity?

A fixed index annuity is a financial product whose terms are defined by a contract between you and an insurance company. It features characteristics of both fixed annuities and variable annuities. Fixed index annuities are also referred to as indexed annuities, index annuities or equity-indexed annuities.

Key Facts About Fixed Index Annuities

- An indexed annuity provides a rate of return based on the performance of a market index like the S&P 500.

- Indexed annuities guarantee a minimum interest rate and you don’t lose money even if the market underperforms.

- The issuing insurance company will cap or limit your gains relative to the underlying index.

Indexed annuities offer a minimum guaranteed interest rate combined with a credited growth tied to a broad stock market index, such as the S&P 500 or the Dow Jones Industrial Average.

This unique hybrid design offers protection against stock market losses, as well as the potential to profit from the market’s gains.

How Does a Fixed Index Annuity Work?

Fixed index annuities work by crediting interest based on the performance of an underlying index. The interest earned is usually credited at the end of the crediting period, which typically ranges from one to seven years. At the end of the guarantee period, renewal rates will apply. These renewal rates will never be lower than the minimum listed in the contract.

You can customize your annuity contract by selecting the index on which to base your annuity’s interest. The most common index options include the S&P 500, the Nasdaq 100 or the Russell 2000.

Calculating Interest on a Fixed Index Annuity

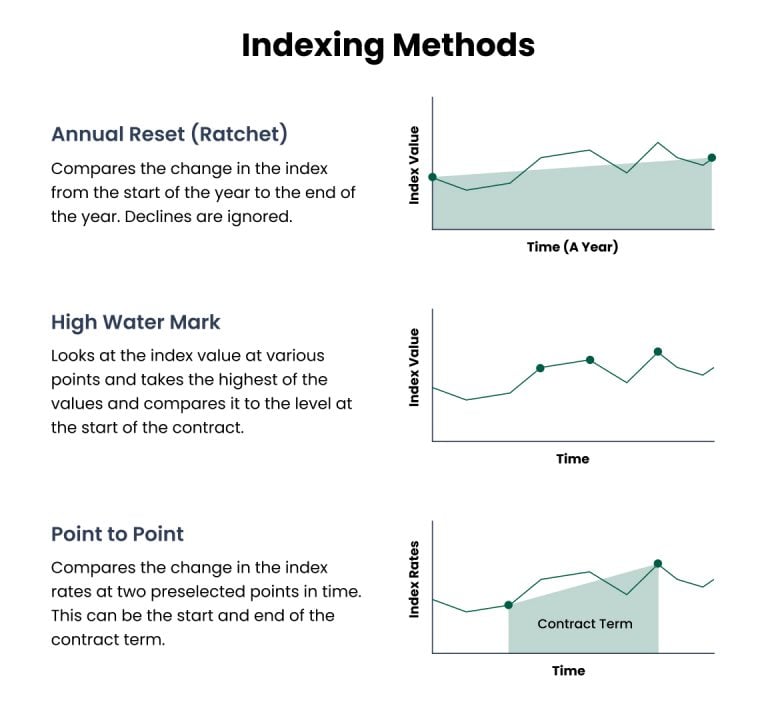

Annuity companies may calculate interest on a fixed index annuity in a variety of ways. According to the Institute of Business & Finance, there are three main methods of calculating indexed annuity interest.

Indexing Methods for Annuities

- Monthly average

- Monthly sum

- Point-to-point

The annual point-to-point method calculates interest based on the percentage change in an index (e.g., S&P 500) from the beginning to the end of a contract year. It applies a cap rate, which limits the maximum credited interest, and zero-floor protection, ensuring that no losses are applied if the index declines.

The monthly average method smooths out volatility by averaging 12 months of index values and then comparing the average to the starting value. Instead of a cap, it applies a participation rate, which determines how much of the growth is credited to the annuity.

The monthly sum method tracks monthly changes in the index, applies a cap rate per month, and then sums the adjusted values at the end of the year. Unlike annual point-to-point, each month’s performance affects the final credited amount.

Using Index Averaging in Interest Calculations

In addition to understanding indexing methods, it is also important to know how insurers use index averaging in interest calculations. According to the Institute of Business & Finance, over 75% of fixed index annuities include an averaging feature.

Averaging can be used in different ways depending on the structure of the contract. In a point-to-point contract, for example, the insurer might use the average of the last year of the contract to compare to the beginning contract value.

Averaging generally means that indexed annuity customers will never receive interest based on the highest point of the index value, but also that they will never be credited interest based on the lowest point of the term.

How Are Gains Limited?

While FIAs provide an opportunity for index-linked growth, insurance companies use certain mechanisms to control the amount of interest credited. These limitations are essential for ensuring that the insurer can guarantee principal protection while still providing market participation.

Who Should Get a Fixed Index Annuity?

Fixed index annuities are best suited for investors who don’t need the money right away. According to licensed financial advisor Chip Stapleton, fixed index annuities are most beneficial for investors with 10 to 15 years before they’ll need income because they’ll have time to weather any downturns that might reduce the annuity’s return.

Most fixed index annuities have some downside protection, said Stapleton, who is a FINRA Series 7 and Series 66 license holder and CFA Level II candidate.

“It might even be a floor of zero, so you’re never going to lose money,” Stapleton told Annuity.org. “But then your upside is also capped there too, so if you want to limit your bad, you also have to limit your good.”